Car insurance is a necessary expense for most drivers. It provides financial protection in case of an accident or theft, but can also be a significant expense. If you’re on a tight budget, finding the cheapest car insurance can help you save money on your monthly expenses. Here are some tips to help you get the cheapest car insurance possible.

1- Shop around and compare quotes

One of the best things you can do to get the cheapest car insurance is to shop around and compare quotes from different insurance companies. Insurance rates can vary greatly between companies, so it’s important to get quotes from several different insurers to find the best deal.

There are many online tools that can help you compare car insurance quotes, such as NerdWallet, Policygenius, and The Zebra. Be sure to compare the coverage limits and deductibles of each policy, as well as the overall price, to find the best deal.

2- Consider increasing your deductible

Your deductible is the amount you pay out of pocket before your insurance kicks in. If you have a higher deductible, your monthly premiums will be lower. This can be a good option if you have a good driving record and are confident in your ability to avoid accidents.

However, it’s important to make sure you can afford to pay the higher deductible if you do get into an accident. If you can’t afford the deductible, you may end up paying more in the long run.

3- Look for discounts

Many insurance companies offer discounts that can help you save money on your car insurance. Some common discounts include:

- Multi-policy discount: If you have multiple policies with the same insurance company (such as home and auto insurance), you may be eligible for a discount.

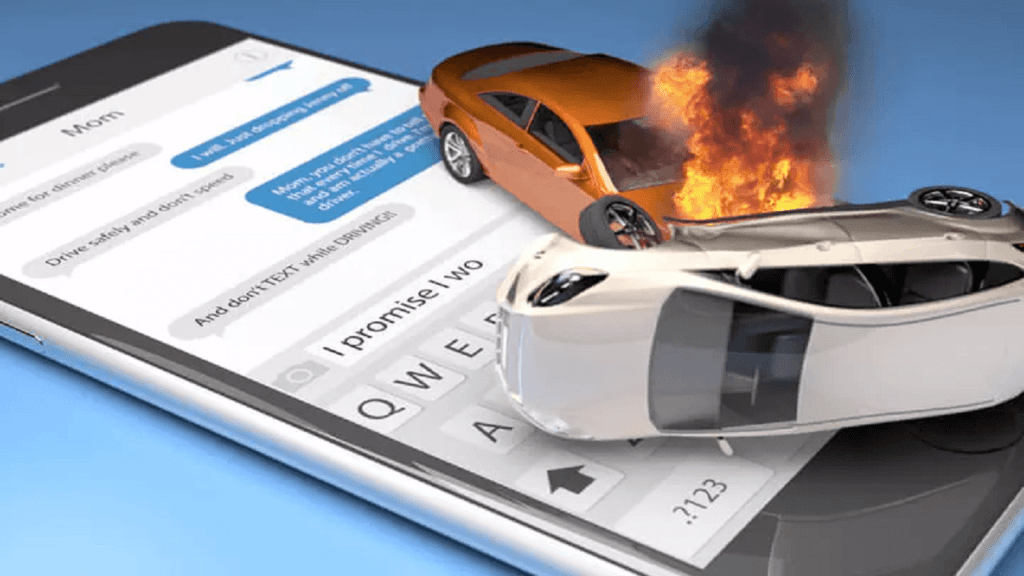

- Good driver discount: If you have a clean driving record and no accidents or tickets, you may qualify for a good driver discount.

- Safety features discount: If your car has safety features such as anti-lock brakes, airbags, or a backup camera, you may be eligible for a discount.

- Low mileage discount: If you don’t drive your car very often, you may be eligible for a low mileage discount.

Be sure to ask your insurance company about any discounts you may be eligible for.

4- Choose a car with a lower insurance rate

The type of car you drive can also affect your insurance rates. Cars that are more expensive to repair or have a higher likelihood of theft are often more expensive to insure.

When shopping for a car, consider the insurance rates for different models. You can use online tools such as Insure.com or NerdWallet to compare insurance rates for different cars.

5- Improve your credit score

Many insurance companies use your credit score as a factor in determining your insurance rates. If you have a low credit score, you may be charged higher premiums.

To improve your credit score, make sure you pay your bills on time and keep your credit card balances low. You can also check your credit report for errors and dispute any inaccuracies.

6- Consider usage-based insurance

Usage-based insurance (UBI) is a type of car insurance where your rates are based on your driving habits. This can be a good option if you don’t drive very often or if you’re a safe driver.

With UBI, you install a device in your car that tracks your driving habits, such as your speed, braking, and acceleration. Based on this information, your insurance company will calculate your rates.

UBI can be a good option if you’re a safe driver or if you don’t drive very often. However, if you drive a lot or have a tendency to speed or brake hard, you may end up paying more.

7- Avoid unnecessary coverage

When shopping for car insurance, make sure you’re only paying for the coverage you need. For example, if you have an older car that’s not worth very much, you may not need collision or comprehensive coverage.

Collision coverage pays for damage to your car in case of an accident, while comprehensive coverage pays for damage to your car from things like theft or natural disasters. If your car is not worth very much, the cost of these coverages may be more than the value of your car.

In conclusion, getting the cheapest car insurance requires some effort and research, but it can be worth it in the long run. By shopping around, choosing the right coverage, and taking advantage of discounts, you can save money on your car insurance while still getting the protection you need.